Human impact on the environment is growing

Our impact is wide ranging from habitat destruction to water pollution, but perhaps the most important from a longer term perspective is anthropogenic (human induced) climate change, with impacts across the globe, from ocean acidification to intense drought and storms, threatening homes, crops and communities, along with extinction of many precious species.

Our greenhouse gas emissions are increasingly scrutinized, with the rise in discussion of ‘ESG’ (Environment, Social and Corporate Governance) along with awareness of what causes emissions. In general, people are familiar with the concept that burning fuel for their car carries with it a ‘carbon footprint’ as does the creation of building materials like concrete, or shopping for fresh fruit from far flung corners of the globe.

But how much impact does extracting the fuel used to power all of these industries have? Do we ever think about how much energy is consumed in simply getting hydrocarbons out of the ground, before they’ve been converted to energy?

The demand for energy is increasing

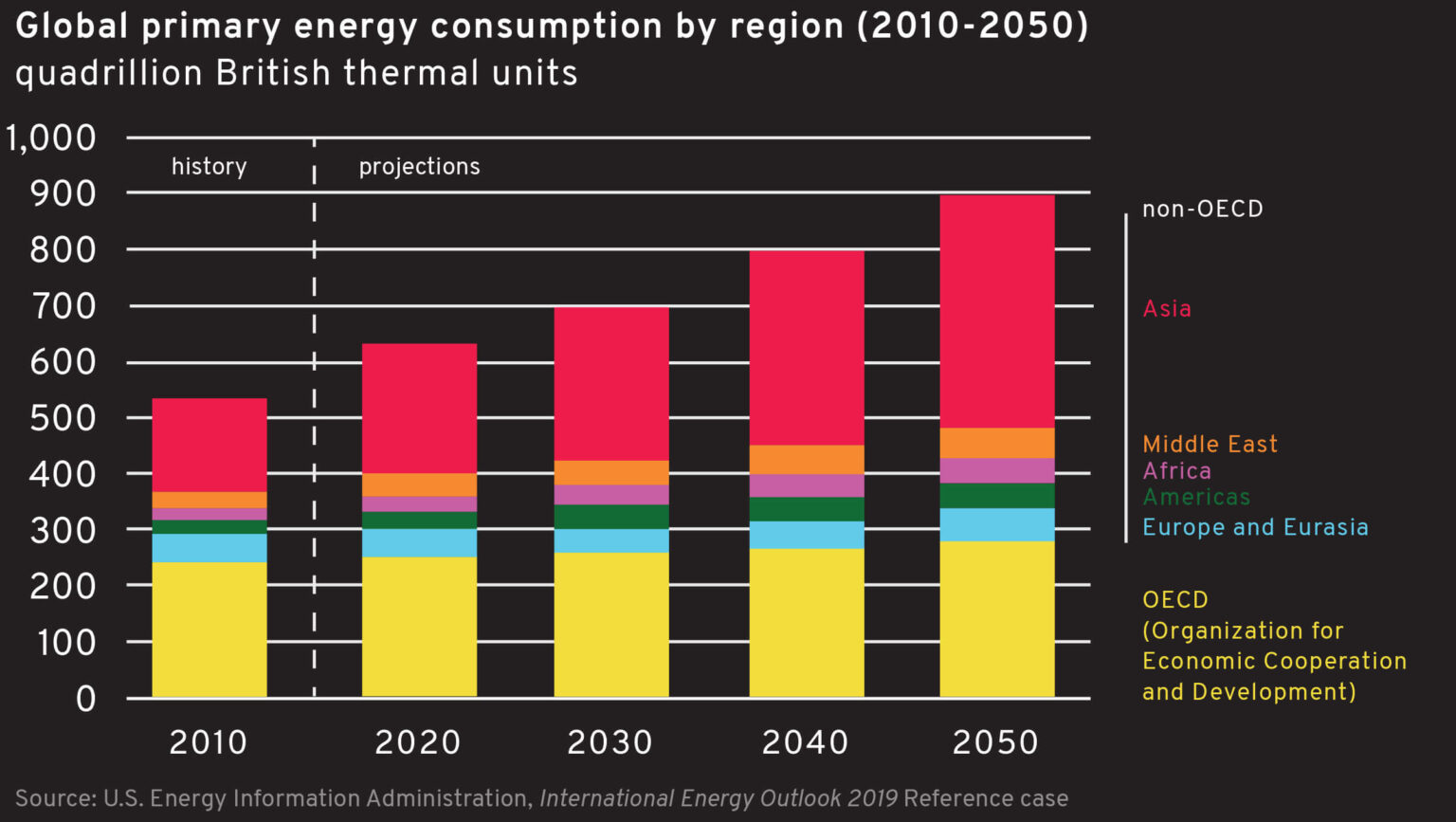

Driven by a combination of population growth and higher living standards, total global energy consumption is forecast to be up by approximately 40% by 2050.

In order to meet this growing demand, hydrocarbons are forecast to be a key component of the energy mix well into the future (U.S. Energy Information Administration, International Energy Outlook 2019).

Unless we want to turn the lights off, we all need hydrocarbons to continue to be discovered and extracted from under the ground.

As an environmentally conscious energy underwriter at Lloyd’s, I have frequently felt myself questioning the environmental impact of my underwriting decisions, and so I was therefore pleased to read in Lloyd’s Environmental, Social and Governance Report 2020 that Lloyds “have … committed to the phasing out of the market’s and the Corporation’s existing investments in thermal coal-fired power plants, thermal coal mines, oil sands, or new Arctic energy exploration activities by the end of 2025.”

There seems to be a general familiarity with the notion that burning coal and oil sands are more environmentally damaging to the environment than other sources. But given that hydrocarbons are a significant part of our energy future, can and should we go further?

The carbon footprint of a barrel of oil

A less commonly known fact is that aside from the emissions of burning a barrel of oil, about 8% of global carbon emissions are produced from physically getting that oil or gas out of the ground and to the refinery gates (www.lundin-energy.com) – that’s before any of it has even been used. And that’s four times more than the entire aviation industry globally.

Whilst I was at first taken aback to learn how high this figure is, it makes sense that the various industrial processes in getting the oil from “well to wheel” require energy – and lots of it. And that’s also why any action to reduce these emissions has the potential to be significant in efforts to reduce anthropogenic impact on climate.

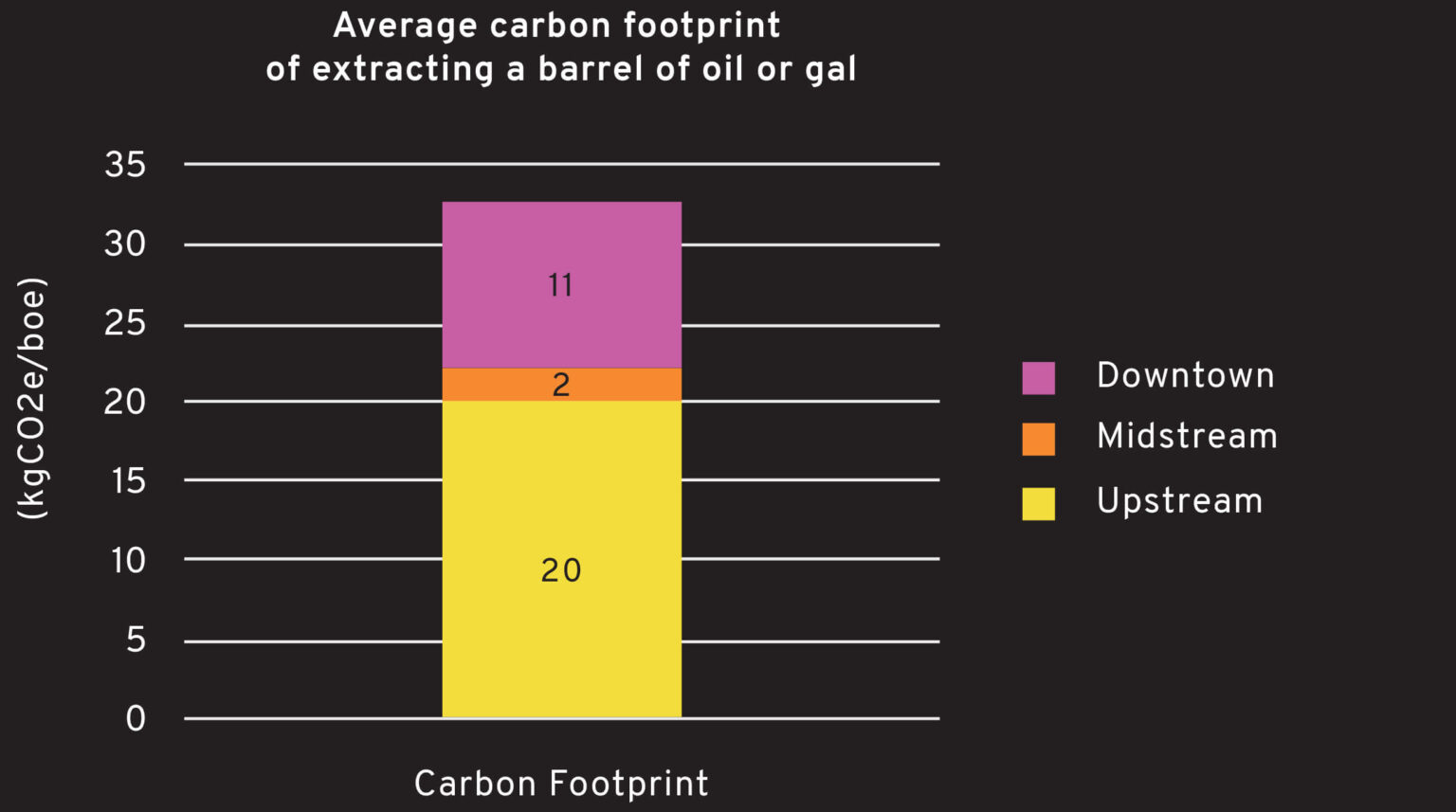

It turns out that of the total energy required to extract an average oil barrel, 60% of greenhouse gasses associated making fuels from hydrocarbons are required for upstream processes including exploration, development, extraction and production. 6% are required for midstream processes, including storage and transport with 33% required for downstream processes which include refining and processing.

Different extraction methods produce emissions in different ways, so to make different sources comparable, emissions are expressed in kilograms of carbon dioxide equivalent per barrel of oil equivalent (kgCO2e/boe). This is referred to as ‘carbon intensity’. The upstream section is the largest so has the most potential for improvement, and it’s also an area in which we see a huge variation in emissions. The range is between less than 5 kgCO2e/boe and over 100 kgCO2e/boe, the former being for some onshore shale fields and the latter being for oil sands production. That’s twenty times more emissions to get the same barrel of oil equivalent from the ground!

Positive impacts: what can Insurers do?

Happily, focus is increasing on ESG issues, and perhaps the question of carbon intensity should come under the spotlight. This quantitative information can be used as a comparison metric thus allowing for a fully informed underwriting decision to be made, including on ‘risk to climate’. If it could be argued that this risk to climate is translated into cost to insurers, then we could take this into account when setting the premium.

Every industry needs insurance in order to function, so as insurers, do we have an obligation to encourage a low carbon intensity, if we can? (This topic worth of another blog in itself!) Once we have the carbon intensity figure for our insureds, we could set an emissions benchmark above which we could either charge an additional premium or decline the risk. Further, we could potentially give a reduction in the premium if we can see that our insured is consciously reducing its impact on the environment and is therefore likely to be lower risk. This would give insureds a tangible cash benefit of reducing their emissions. *

One of the many benefits of working for a start-up where an environmental policy is not yet fully formed means we can ensure we create a policy that’s relevant for a world where ESG is at the forefront of decision-making.

*Views expressed here are those of the author and not necessarily those of Inigo.