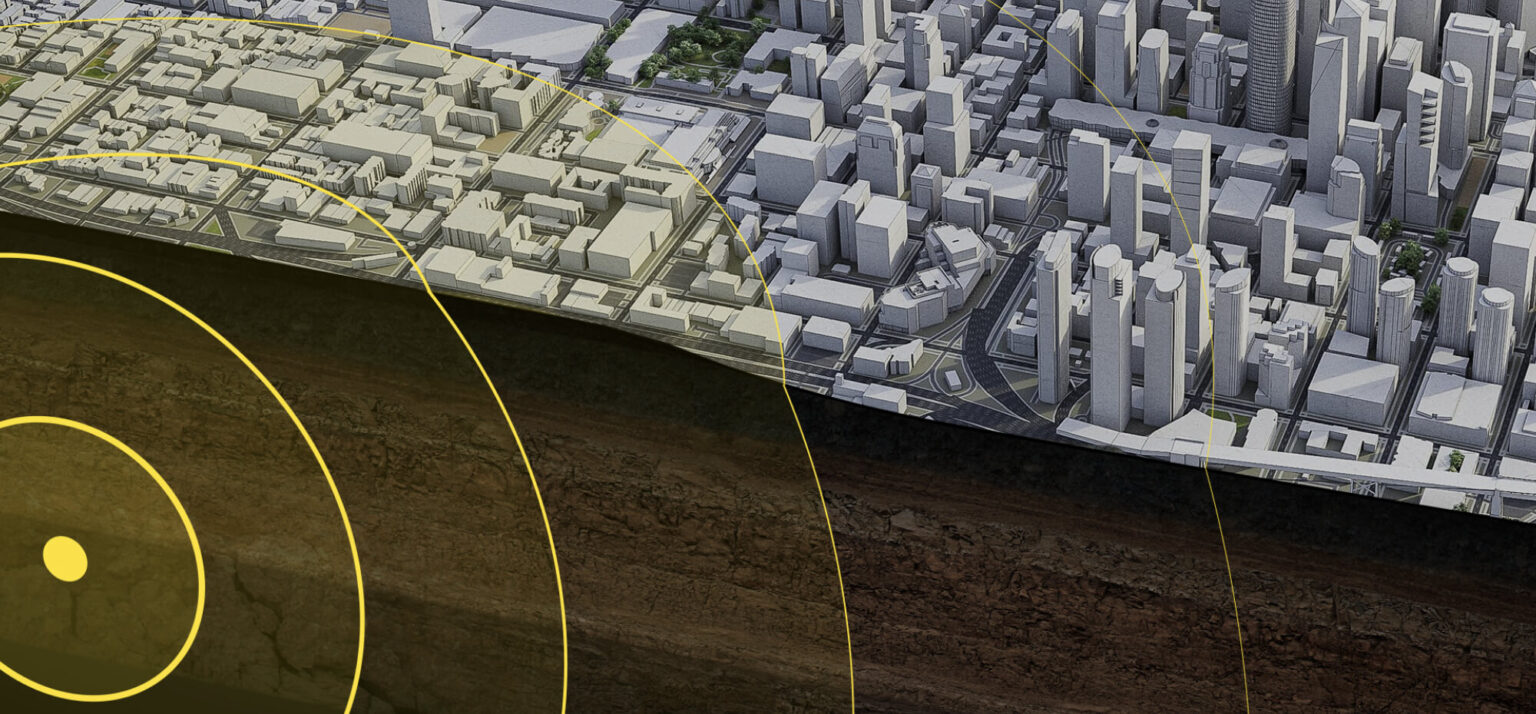

Inigo has priced its second catastrophe bond in 2022. Montoya Re II closed yesterday and is a $110m transaction covering North American named storms and earthquakes. It responds on an industry loss and annual aggregate basis and will be on risk until the end of March 2026. The coupon is 14% above money market fund returns. The bond was structured by Aon Securities and fronted by Hannover Re.

Adam Alvarez, Head of Insight at Inigo, said,

“We are very pleased to have sponsored our second catastrophe bond just nine months after the first. Montoya II will provide Inigo with a further $110m of peak zone protection at a turbulent time in the market – this will bring the total amount of outstanding cat bond limit to $225m.

We continue to find that the risk appetite of ILS investors is complimentary to other providers of contingent capital. We were pleased to see that Montoya II attracted investment from both specialist ILS funds and more generalist investors. A rolling programme of issuance will further increase Inigo’s ability to support our clients throughout the cycle. We see these types of transaction as an integral part of the way that Inigo finances its business.”

The first catastrophe bond by Inigo, Montoya Re, was launched on 1 April and was a $115m transaction covering earthquake and windstorm risk in the US, Canada and Japan. The risk period was set as three years with a coupon of 6.75% above money market fund returns.